Are you an athlete or a sports club that has just received a sponsorship donation? Or perhaps you're a gallery, and your supporters provide you with sponsorship donations? You might be surprised to learn that, from a legal perspective, the term "sponsorship donation" is nonsensical. The terms "donation," "sponsorship," and "barter" are often confused and combined, even though their legal implications differ significantly. What do these terms actually mean, and what are they best suited for? Let's clear things up.

Donation

In the case of a donation, one party (the donor) transfers ownership of an item (certain assets or money) to the other party (the recipient) free of charge. In a sports context, this usually involves donations of financial resources, sports equipment, or nutritional supplements. Similarly, in the arts, it may involve providing funds to create new works of art, support young artists, or organize cultural events. Donations of artworks or entire collections to galleries are also possible.

„

It doesn't matter what the contract is titled—'sponsorship' or 'donation'—it will always be assessed based on its content.

A key aspect of donations is that the donor expects nothing in return, and the recipient has no obligation to provide anything in exchange. In practice, symbolic recognition from the recipient, such as a thank you, is allowed, proportional to the significance of the gift. However, if you receive a sum of money and, in return, display the donor's logo on all posters, tickets, websites, social media, etc., it is no longer considered a donation but sponsorship.

Sponsorship

Sponsorship, on the other hand, is a mutually beneficial relationship between the sponsor and the sponsored party. While a donation is free and comes with no obligation, a sponsor receives a return on their investment. A sponsor financially or materially supports the sponsored party, and in return, the latter agrees to promote the sponsor within their activities. The consideration in a sponsorship agreement may include placing the sponsor's logo on tickets, displaying it in prominent locations (posters, banners), or placing it on items funded by the sponsorship (for a sports club, typically jerseys, equipment, or the club’s bus). It may also include promotional spots, among other things.

.jpg)

Sponsorship is defined by Section 1(4) of Act No. 40/1995 Coll., on the Regulation of Advertising, as: "a contribution provided with the aim of supporting the production or sale of goods, the provision of services, or other activities of the sponsor."

In sports, sponsors aim to associate their name with a specific athlete, sports club, or even a particular team, stadium, or significant sporting event. A recent example is the French luxury goods manufacturer LVMH, which became one of the sponsors of the Summer Olympic Games in Paris, under which it includes fashion brands such as Louis Vuitton and Dior, as well as champagne and spirits brands like Moët Hennessy, and the jewelry house Chaumet.

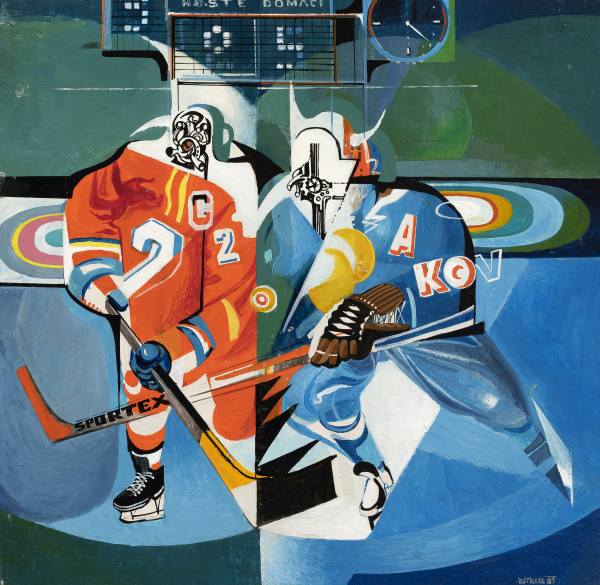

Sponsorship in the arts is common, particularly in the form of supporting major galleries and artistic projects. For example, BMW sponsors exhibitions at London’s Tate Modern and participates in the BMW Art Car project, where renowned artists design the cars. Another example is the sponsorship of prestigious art fairs like Art Basel, where sponsors help finance the exhibitions and gain visibility through promotional activities, such as logos on printed materials, banners, and other promotional items. Fashion brand Gucci has sponsored major exhibitions at the Museum of Modern Art in New York, thus strengthening its prestige in the field of culture and art. In the Czech Republic, Komerční Bank is a long-term sponsor of the National Gallery in Prague, contributing to the organization of exhibitions and cultural events.

Sponsorship vs. Advertising

According to Section 1, paragraph 2 of Act No. 40/1995 Coll., on the regulation of advertising, advertising is defined as “a notice, demonstration, or other presentation disseminated primarily through communication media, aimed at promoting business activities, specifically encouraging consumption or the sale of goods, construction, leasing or sale of real estate, the sale or use of rights or obligations, the promotion of services, or the advertisement of a trademark, unless otherwise specified.”

While advertising aims to persuade its audience to change their behavior, sponsorship focuses on aligning the sponsor's brand with the values of the sponsored entity, such as a specific sports event, exhibition, or cultural activity. From a tax perspective, however, the distinction between advertising and sponsorship does not matter.

Why is it important to distinguish between a donation and sponsorship (advertising)? Because of taxes.

An amateur sports club is most often structured as an association and, as a non-profit organization, must carefully distinguish between donations and sponsorship contributions. The same applies to galleries or museums if they are non-profit organizations (e.g., an association, a public benefit organization, a foundation, or a fund). While a received donation, as a non-monetary benefit, is exempt from income tax, sponsorship contributions are considered income and are subject to income tax.

From the donor’s perspective, a donation is not considered a tax-deductible expense. However, if legal conditions are met, the donor can deduct the value of the donation from their income tax base, as it is a non-repayable contribution for sports or cultural support. For a sponsor, the sponsorship contribution is a tax-deductible expense since they paid for the sponsorship or advertising (distinguishing between the two is not significant for tax purposes), which they receive as compensation from the sports club or gallery.

Another important distinction between a sponsorship contribution and a donation is that sponsorship contributions are subject to value-added tax (VAT). The value of the sponsorship is also included in the turnover for assessing the obligation to register for VAT in the case of non-profit organizations. Currently, the obligation to register arises if the turnover exceeds 2 million CZK over the last 12 consecutive months. Significant sponsorship contributions may lead to the recipient becoming a VAT payer, a situation many non-profit organizations try to avoid.

Final Tips:

- Be aware that the title of your contract—whether "sponsorship" or "donation"—is irrelevant. The contract will always be assessed based on its content. If the donor is promised promotional compensation in the contract, it will be considered sponsorship with all the above-described consequences.

If you receive non-monetary contributions from your supporter (e.g., jerseys, sports equipment, a sculpture), ensure the (real) value is stated in the contract. This can save you from potential disputes with the tax office.

Don’t rely solely on verbal agreements—always formalize contracts in writing. It’s a good idea to have a simple donation agreement template ready for donations. In sponsorship agreements, we recommend thoroughly specifying the promotional services, including timelines, the duration of the contract, and possible penalties.

The new column Paragraf is a series of articles by lawyer Liběna Šrámková, offering practical legal advice in the fields of art and sport. Her insights aim to raise awareness about the legal aspects of these disciplines.